The adventure of refinancing my house began with a phone call to a radio show. It was a Saturday afternoon, and I usually have some sort of talk radio humming in the background to keep me company as I tool around my workshop. The hosts of “The Real Estate Radio Show,” a local program that is broadcast from Birmingham, Alabama, were discussing the advantages of refinancing a house to get a lower interest rate. This is something I had been seriously contemplating, but I didn’t know how to get the ball rolling.

In fact, I knew very little about the process. I knew the basics: It’s better to pay less interest than more interest, but I didn’t know what qualifications were necessary to make the magic happen. And, I was under the impression that I, the homeowner, would have to meet certain criteria. This notion came from my credit union, where I had previously inquired about refinancing a home. Mortgage refinancing was a new service for my credit union to offer, and when I asked about basic qualifications I was told that I would need a good credit score, as well as 10 percent equity in my home. I didn’t have 10 percent equity—not on paper, anyway. Although, I had made a down-payment upon closing the house, it wasn’t a 10-percent down-payment, and since I’d only been paying the mortgage for about two years, the monthly payments were largely being eaten by interest and not chipping away at principle.

For those two years, I had been using a different strategy to build equity in my home. Rather than paying down principle, my extra dollars were going toward remodeling the home. My wife and I had purchased the house in 2008. This was just before the bottom fell out of the economy. The house was a “fix ‘er upper” and since I work in the home-improvement industry, it offered me an ideal project house for many renovations. I’m a do-it-yourselfer with a good deal of experience, and knew I could fix up the house without having to fork over big bucks for contract labor.

Since purchasing the home, I had built a 300-foot privacy fence, a 440-square-foot deck, replaced all the flooring with porcelain tile or tongue-and-groove wood, installed a new egress and back door, replaced the front entryway, knocked out a partition wall and built a bar, completely remodeled the kitchen with new appliances, countertops and heated floors, added a gutter system, replaced all the lighting and plumbing fixtures, installed crown moulding throughout the home, and completely repainted the house (inside and out). And, this is not even an exhaustive list of the upgrades. Suffice it to say that despite not having 10 percent equity on paper, I was confident that upon reappraisal the renovations would surely have gained enough equity to meet the qualification to refinance my mortgage. This was my theory, but I wanted to verify it with the good folks at “The Real Estate Radio Show.”

Here’s what I learned.

The Wrong Question

Under the pretense that I needed some degree of equity in my home, I dialed-up the radio show. The hosts served double-duty as radio hosts and mortgage lenders.

“I bought a house a little over two years ago,” I explained. “Now that the interest rates have dropped, I’d like to refinance the mortgage. Although I don’t have much equity on paper, I have completely remodeled the house and expect that when the house is reappraised I’ll have earned more equity than is reflected on my current principle balance. So, my question is: What is the minimum amount of equity I need to qualify for the mortgage refinance?”

At first, hosts Charles Tuttle and Eileen Rattiner Carter seemed a little unclear on how to answer. This was my fault, because my question rested on a faulty premise. What I learned was that there is not necessarily a minimum amount of equity required. Although my credit union required 10 percent, it turns out that was a rule specific to my credit union, but not all mortgage lenders. Well, I thought, at least that’s one hurdle I’ve overcome.

Eileen was very helpful and affable, explaining to me where I should concentrate my energies in pursuit of the refinance:

• How is my credit score? Lenders aren’t likely to give people with poor credit a very low interest rate because low credit scores are like red flags for risky loans. A good credit score is critical to making the refinance work. (I had good credit.)

• What is your current interest rate and term? It will cost money to refinance, so you want to make sure you can justify the cost by the money you’ll save in the long run through a lower rate.

• What are you trying to accomplish? Do you need cash out for debt consolidation, are you trying to shorten the term, or do you have other investment plans? For me, it was all about lowering the interest rate to save some cash. At the time, my wife was expecting our first child. I knew I was staring down the barrel of daycare bills and diaper expenses, so I was trying to trim the fat anywhere I could.

• “Once I pull someone’s credit and the score is above 640, I know I can move on,” said Eileen. “I then request two months of bank statements, a month of paycheck stubs, W2′s from the last two years, and a driver’s license and social security card.”

These are the qualifications one needs to meet in order to refinance their mortgage. However, depending on how you want to, um, finance the refinance, there’s more you need to know.

“The most important thing to remember is we need solid credit and the house to appraise favorably,” explained Eileen. “The appraisal process holds the key as to whether a loan can move forward.”

As I mentioned, there are fees to refinance the home, just like the closing costs when purchasing a home. In the best of circumstances, you can roll these fees into the loan so the only out-of-pocket cost you need to cover is the appraisal fee. And, after all the extensive remodeling I’d done, I was confident that my house would appraise favorably—surely enough to cover the closing costs. In fact, I was eager for the appraisal to see how much equity I had gained through all my sweat and effort. Eileen put me in touch with an appraisal service, the appraiser showed up at my house, and I paid him 400 bucks to estimate the value of my home.

A few days later, I was emailed the appraisal report. The figure hit me like a bucket full of dirty mop water. These figures couldn’t be right, I thought. What gives?

The Economy Can be an Evil Mistress

Recessions: I don’t like ‘em. Thankfully, over the past couple of years I’ve remained gainfully employed throughout the economic downturn. I was thinking I may even skate through The Great Recession largely unscathed. However, my reappraisal experience taught me that the housing market is very much interconnected to the economy as a whole, and since the whole mess started in the housing sector, home values have greatly diminished.

In a nutshell, despite my extensive renovations, the home initially appraised for $5,000 less than what I paid for it just 2 years ago. I wanted to cry. How could thousands and thousands of dollars in improvements equate to a significant loss of equity in as little as 2 years?

My email to Eileen read, “I’ve completely remodeled the house, and it appraises at 5,000 less than the day I bought it? This is the most depressing thing I’ve read in a long time.”

“I am sorry!” she replied. And I believed her, but that didn’t help my situation.

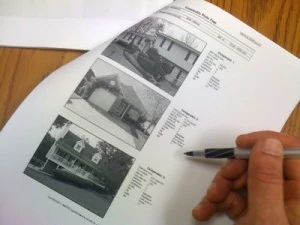

I soon made the painful discovery that all sorts of factors affect a home’s appraisal value. The condition of your house, the local market and recently sold “comparable” homes all affect the dollar amount of your property. Sure, it helps if you’ve done a lot of structural improvements, but much of that equity building is offset by the economic stature of your community. Sadly, these days practically everyone’s community has been affected by the recession, and I wasn’t surprised to see on my report that foreclosures in the area were a factor in determining my home’s value. I was surprised, however, at just how significant a role such factors play.

So, where did this leave me? I asked Eileen to give me the bottom line, no matter how ugly it was. “The appraisal doesn’t cover the new loan amount,” she said, “which would mean you would have to come out of pocket on closing costs.”

In other words, to move forward I would have to cough up a few thousand dollars to pay for the refinance. Because I had a baby on the way, this was not an option for me. I’d never had a kid, but I knew there would be lots of medical bills and baby expenses coming down the pike, and I wanted to make sure I had a “cushion” in the bank to help absorb the blows. What if the baby had unexpected health problems, requiring some surprise obscene expenses? For the baby’s sake, I felt I had to hope for the best but prepare for the worst. Preparing for the worst meant that at the time, I could not tap my bank account to cover the closing costs.

The Right Question

Things looked grim. I had tried; I had failed. So much for refinancing the mortgage, I thought. Back to square one. In retrospect, I should have asked a better question when I first called the radio show.

Via some sort of time warp, I would have asked, “How can I refinance my house and make sure all the closing costs are wrapped into the loan amount?”

That’s a loaded question, of course. Evidently, all sorts of things affect a home’s circumstance, and that is what I hope to convey with this article.

Fortunately, all was not lost. Eileen had an idea, albeit perhaps a long shot.

“I need you to look at the report and the three homes [the appraiser] used to compare yours to,” she said. “You are able to contact the appraiser to ask him to reconsider if you can give him additional information.”

I contacted the home appraiser and plead my case. I asked why my renovations had seemingly been entirely discounted when estimating the home’s value. He said that without my renovations, the appraisal would have been significantly lower. I shutter to think what that figure might look like. Nevertheless, he was sympathetic to my plight of not wanting to flat-line my bank account to pay closing costs a mere month before having a baby. He said he would take a second look at my residential area to see if he could find other recently sold homes, which could be used as a comparative guideline by which to better reflect my home’s value. I won’t pretend to know exactly what he did, but a new report came back showing an increase in the home’s value by $6,000. I guess he discovered some better homes to use as a comparison. This meant that all my home improvements had netted a total gain of $1,000 of equity when compared to the purchase price.

Although this was still much lower than I was hoping, it was workable. This new appraisal quote, coupled with some minor adjustments in my interest rate, finally amounted to a loan I could afford. I was able to drop my interest rate by more than 1.5 percent, which frees up some extra money every month that will be allocated to the baby budget. In the end, everything worked out, but I wish I had known to expect so many twists and turns along the way—the process would have been much less stressful. Hopefully this article will provide a little insight on what to expect if you’re pursuing a refinance.